ct sports betting tax

Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. In addition to this your gambling income will be subject to federal tax.

Sports Betting Vs Netflix Which Costs You Less

Connecticut lottery can take up to 15 retail sportsbooks.

. Sports betting taxes apply even if you are wagering just for fun and not only to the professional bettors. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. Connecticut state taxes for gambling.

The companies will also pay a 1375 percent tax on sports and fantasy sports betting. Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first. A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by.

A 1375 tax rate on sports wagering and an 18 tax. That led to more than 1 million total taxes paid for the month. A 1375 percent tax rate on sports wagering.

Online casino gaming and sports betting has been live in Connecticut since Oct. This is a flat rate meaning that it applies to everyone winning money regardless of how much money they win and how much their annual income is. The Illinois sports betting tax rate is 495.

For more legal casino and sports betting news across the US follow us on twitter Gamble_usa for the latest news and offers. The money that you gain by gambling which includes sports betting as well is subject to income tax. 19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of betting under the new system on a total of 366 million in wagers.

This law applies to all CT Lottery. Reportable for federal tax purposes OR. If the winner is a part-year resident of Connecticut and meets the gross income test gambling winnings are subject to Connecticut income tax to the extent includable in the winners federal adjusted gross income and to the extent the winnings were received during the Connecticut residency portion of the winners taxable year.

Many punters were wondering whether they need to pay liabilities on their profits from sports betting. This rate applies equally to both the tribes and the lottery though the latter is apparently seeking to. Registration is allowed in any state outside Connecticut but bets can be placed only in Connecticut.

The PlaySugarHouse Sportsbook service is operated by Rush Street Interactive CT RSI CT an affiliate of a US-based casino group Rush Street Gaming that owns and operates several leading land-based casinos in the US including the Des Plaines-located Rivers CasinoThe RSG group has been developing land-based casinos in North America since 1996 and fully understands the. The state will collect taxes of 18 initially on online. Connecticut Governor Includes new Tax Revenue in Budget Proposal.

The retail sportsbooks through the Connecticut Lottery added 88 million in handle and 827609 in revenue. Bettors cannot place wagers on Connecticut college sports teams. All gambling winnings are subject to Connecticut income tax.

Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. Mohegan Digital took in 123 million in wagers and paid. Proceeds will go to a college fund to allow students to attend Community College for free and also to fund some smaller municipalities in the state.

Sports betting tax rate The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. Connecticuts tax coffers gained about 25 million from online casino gaming and 17 million from sports betting last month on a total of 4446 million in wagers.

Connecticut Lottery shall have the right to sublicense locations to the state-licensed parimutuel operator. Osten co-chair of the Appropriations Committee told CT Examiner that legislators expect about 80 million in additional revenue for the state from all new forms of gambling. The sports betting tax rate for CT is 1375.

Online casino games online were a lot bigger than sports betting. 10 Free Play 300 Matched Bonus. Facilities are required to withhold 24 of your earnings for federal withholding tax.

Connecticut online sports betting took a major step forward this week after gaming bills advanced to the states House of Representatives. When sports betting will be legalized the tax is expected to be at 7 - 10 or similar to lottery winning that stands at 699. State Sports Betting Tax Design Vary Widely.

Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed. Connecticut will get its cut of online casino gambling and sports betting. 24 Tax Withheld.

The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at. State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either. The total amount owed for taxes on gambling winnings depends on the total amount earned by.

The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24. Connecticut adopted emergency regulations Tuesday intended to. So to be straightforward yes.

Connecticut nets 4M in first full month of sports betting. Horse or dog races winning in Connecticut are subject to a 30 tax. April 18 2022 Connecticuts three mobile sportsbooks combined for 1319 million in handle and 67 million in revenue during March.

Football MLS fanatic. Subject to federal withholding tax.

Online Sports Betting Sites Sports Betting Betting National League

Assessing State Sports Betting Structures Aaf

Regulators Move To Determine New York Online Sports Betting Licenses

Connecticut Reports 16 Million In Sports Betting Revenue In First Full Month

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lucky Numbers For Lottery Lottery Numbers

Sports Betting Is Now Legal In Several States Many Others Are Watching From The Sidelines

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Will You Have To Pay Ontario Sports Betting Taxes Faqs

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Connecticut Lottery Corp Opens First Retail Sports Betting Venue More Are Planned To Open Sports Betting Betting Lottery

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

Connecticut Sports Betting Expands With First Commercial Sportsbook

Trudeau Government Moves To Legalize Single Event Sports Betting Bnn Bloomberg

Wild Nfl Weekend Spelled Losses For Sports Betting Firms Testing Ct S New Market

Why Sports Betting Is A Low Margin Business

Ibia Adds Betent S Dutch Sports Betting Brand Betcity As New Member Yogonet International

New York Takes A Gamble With 51 Tax On Online Sports Betting

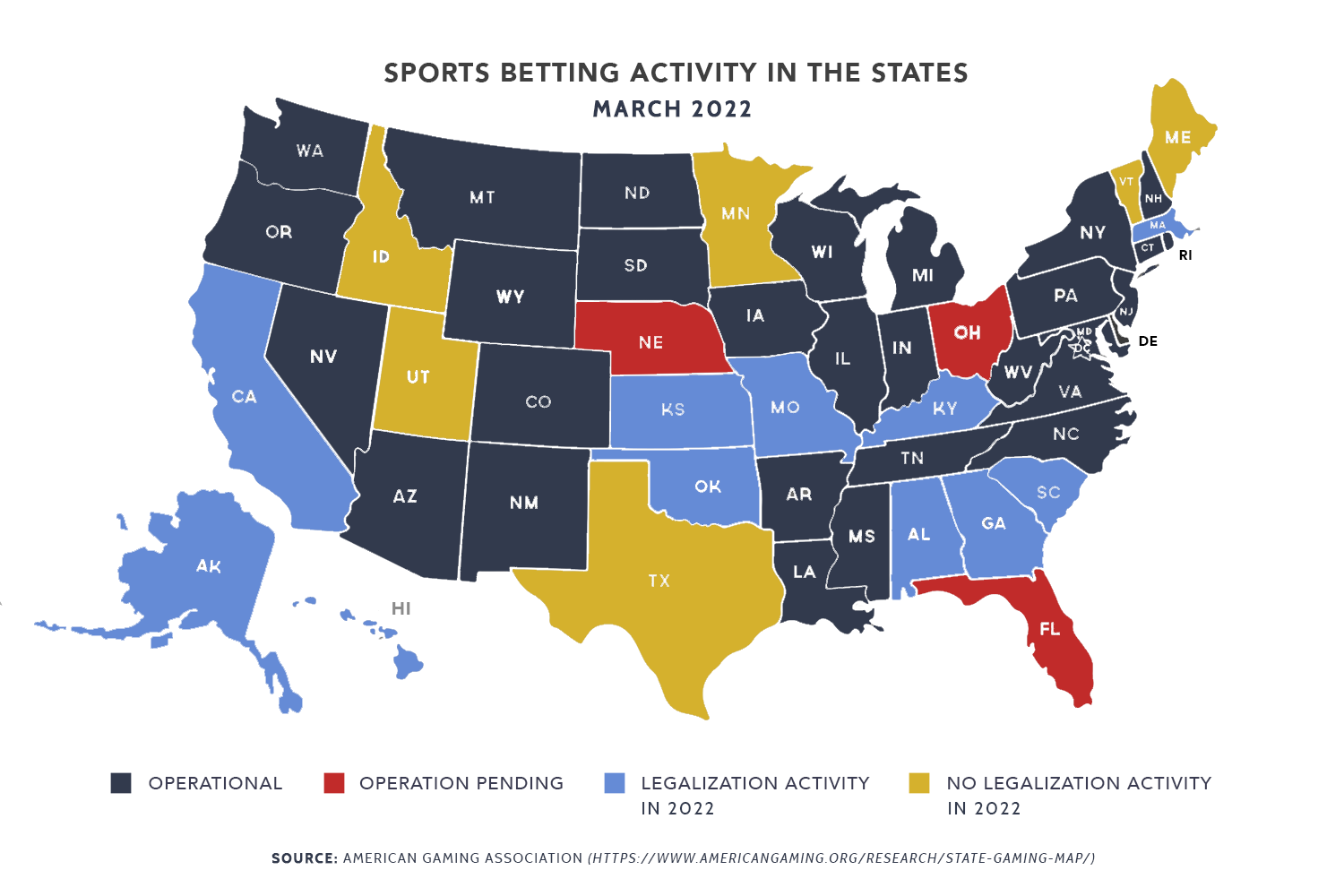

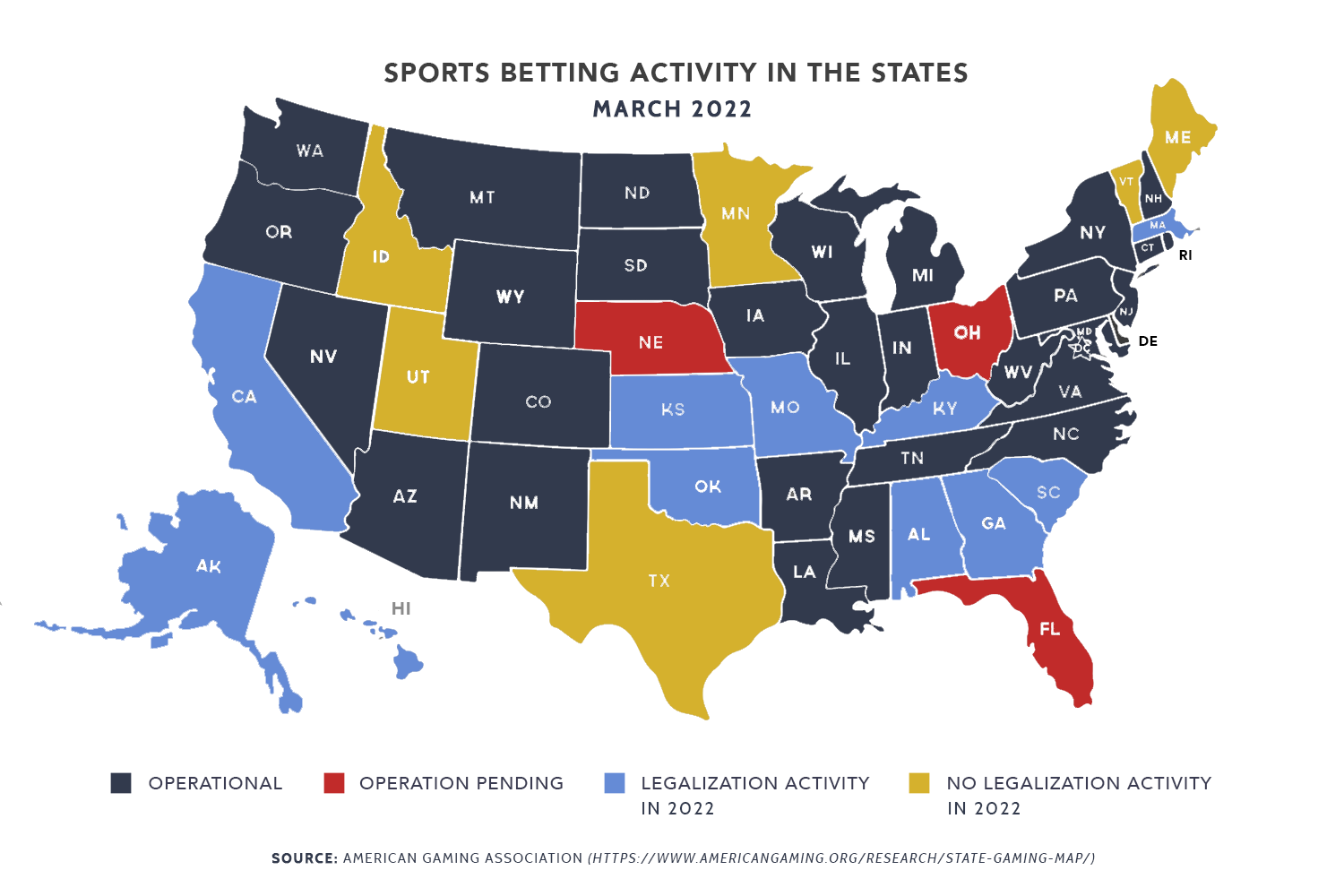

Interactive Map Sports Betting In The U S American Gaming Association