when will capital gains tax increase in 2021

What is capital gains tax CGT. If you sold a buy-to-let property between 6 April 2020 and October 27 2021 and are required to pay CGT you have 30 days from the completion date to notify HMRC and make a payment.

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

For 2021 tax rates on short-term capital gains.

. The 28 limit doesnt apply to short-term capital gains. The person residing must meet all criteria to avoid the capital gains tax on a property sale. In the 2022-23 tax year this is 12300 unchanged from 2021-22.

It could increase their total taxable income to a level where they would incur. Here are the federal incomeshort-term capital gains tax rates for 2021. What is the capital gains tax rate in Canada.

If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021. A capital gains tax is a tax on the increase in the value of your investments over time. The good news is that the tax code allows you to exclude some or all of such a gain from capital gains tax as long as you meet all three conditions.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. For 2031 the SALT deduction cap would be set at 10000.

12950 for an individual return 19400 for heads of households and 25900 for a joint return or more if the taxpayer has over that amount in itemized deductionsAmounts in excess of this are taxed at the rates in the above table. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

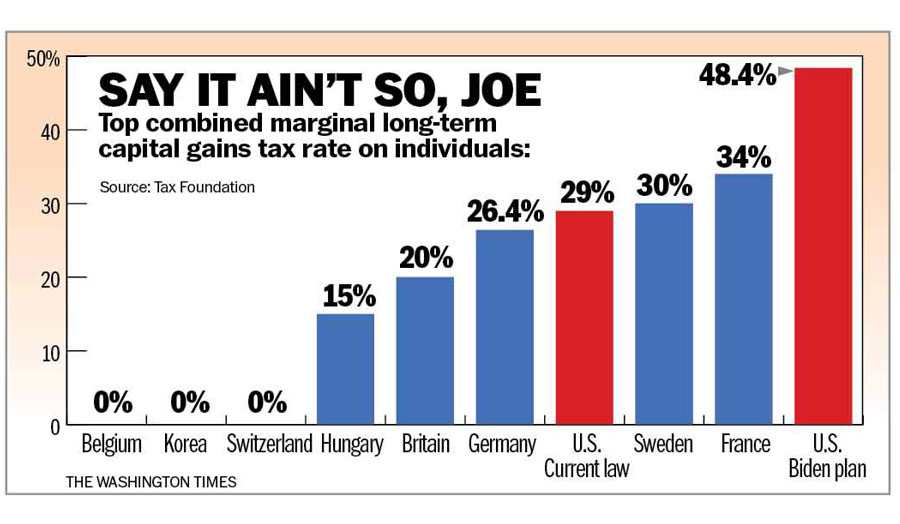

Increase Your Credit Score. However a 28 percent federal corporate income tax rate combined with Bidens proposal to tax long-term capital gains and qualified dividends at an ordinary income tax rate of 396 percent for income earned over 1 million would make the top integrated tax rate on corporate income in the US. Firstly the house that the resident is selling should be the primary residence 6.

And relatively little in the first two years due to reduced realizations for capital gains. CGT is a tax you pay on the profits you make when you sell an asset. Capital Gains Tax.

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Actual revenue may be reduced further to the extent high-income individuals engage in other avoidance techniques that result. But if youre in a higher tax bracket ie 32 35 or 37 then the capital gains tax on your collectible gains is capped at 28.

Learn about long- and short-term capital gains tax on stocks. The gain is not realized until the asset is sold. The federal tax rates for 2021 can be found on the Canada Revenue Agency CRA website.

In the 2022-23 tax year this is 12300 unchanged from 2021-22. Capital gains tax is the tax Americans must pay on any profits generated from the sale of assets including stocks real estate and businesses. However theyll pay 15 percent on capital gains if their income is.

What is the 2021 long-term capital gains tax rate. However it was struck down in March 2022. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

The long-term capital gains tax rate is 0 15 or 20. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS. The highest in the OECD at 627 percent see.

In simple terms a capital gain is an increase in the value of an investment such as stocks or shares in a mutual fund or exchange traded fund or real estate holding from the original purchase price. It is mainly the case when a local sell hisher home 5. Separately the tax on collectibles and certain.

Was then let out for only a year and then you had to pay CGT on the whole 21 year price increase. The standard deduction for 2022. If you hold your assets for longer than a year you can often benefit from a reduced tax rate on your profits.

CGT applies to assets that you purchased on or after 20 September 1985. When do I have to pay capital gains tax on buy-to-let. Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

Increase your tax knowledge and understanding all while doing your taxes. The 80000 SALT cap amount would also apply to the 2021 tax year. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year also known as a long term investment.

It needs to. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Those in the lower tax bracket could pay nothing for their capital gains rate while high-income taxpayers could save as much as 17 off the ordinary income rate according to the IRS.

Youll only need to pay tax if your profit or gain is more than the capital gains tax allowance. Long-Term Capital Gains Tax Rates for 2021. Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth than the purchase price.

In 2021 to 2022 the trust has gains of 7000 and no losses. The UK outlines a few circumstances that make evading capital gains tax on a property sale possible. However taxpayers pay no tax on income covered by deductions.

This method allows you to increase the cost base by applying an indexation factor based on the consumer price index CPI up to September 1999. The income range rises slightly to the 41675459750 range for 2022. Filing Status 0 15 20.

40401 to 445850. For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income.

President Biden S Capital Gains Tax Plan Forbes Advisor

Congress Readies New Round Of Tax Increases

Capital Gains Nonsense Econlib

Inflation Coupled With Democrats Proposed Tax Increases Are A Recipe For Disaster Washington Times

Short Term Vs Long Term Capital Gains White Coat Investor

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

2021 2022 Capital Gains Tax Guide Short And Long Term Sofi

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

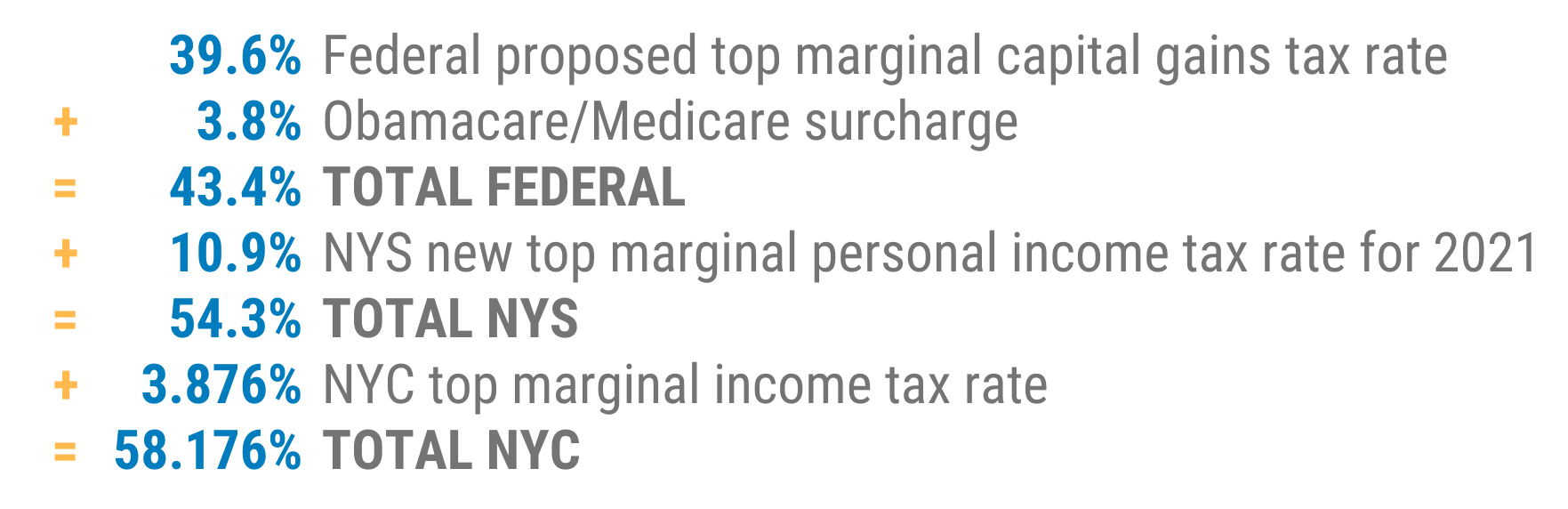

Do The Math Cap Gains Tax Hike For New Yorkers Dsj Cpa

Capital Gains Tax In The United States Wikipedia

New Capital Gains Tax Increases And Home Sales Osprey Accounting Services

Short Term And Long Term Capital Gains Tax Rates By Income

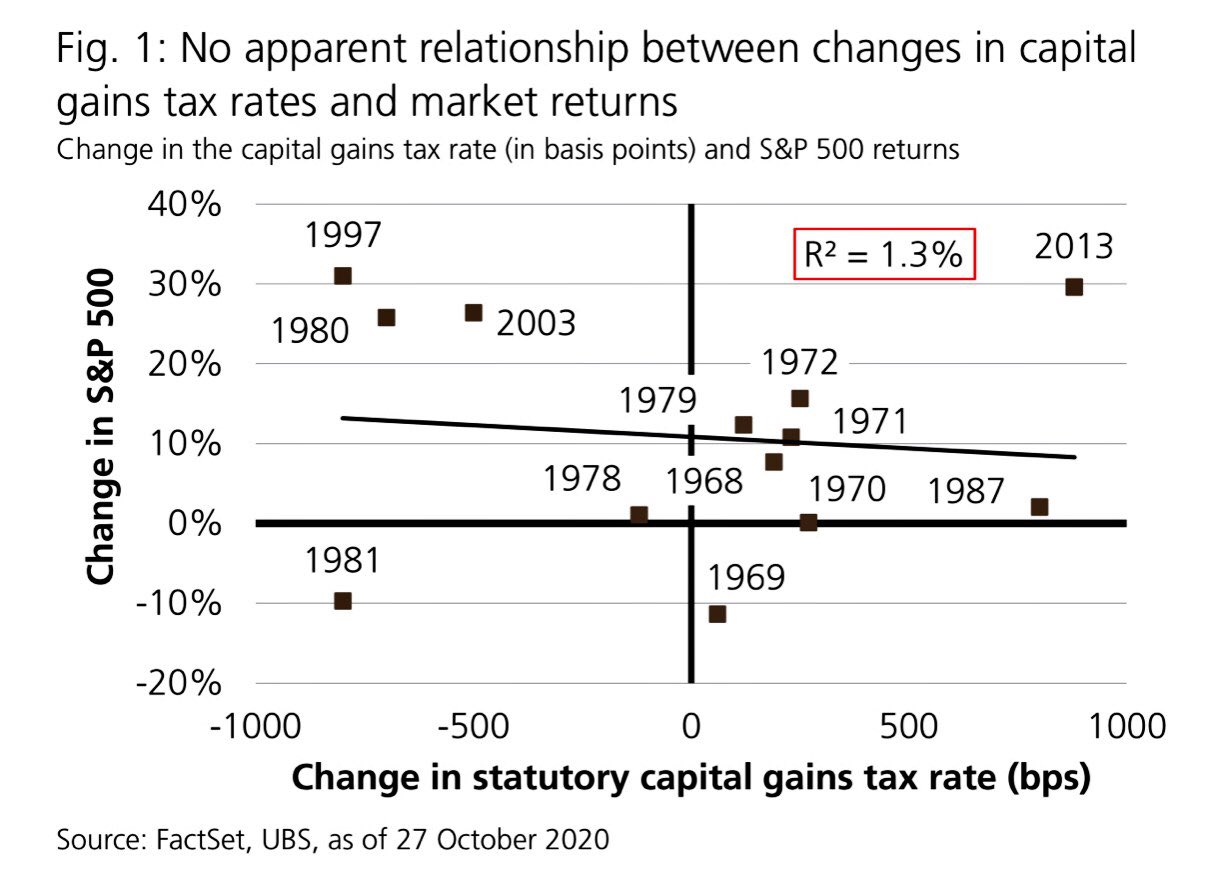

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Short Term And Long Term Capital Gains Tax Rates By Income

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)